Structured settlements provide long-term financial stability to individuals who have suffered personal injury or loss. However, what happens if the insurance company responsible for making the structured settlement payments becomes insolvent? In Canada, Assuris plays a crucial role in safeguarding the interests of individuals receiving structured settlements. In this article, we will explore how Assuris coverage works specifically for structured settlements and the recent increases to Assuris coverage that protects structured settlement recipients.

What is Assuris?

Assuris is a not-for-profit organization established under the Canadian Insurance Companies Act. It acts as a compensation fund, protecting policyholders and individuals with structured settlements when a member insurance company fails. Assuris guarantees that structured settlement recipients continue to receive their payments, subject to Assuris coverage limits, even if the funding insurance company encounters financial difficulties.

How Does Assuris Coverage for Structured Settlements Work?

1. Protecting Payment Streams:

Assuris coverage ensures that the periodic payments established in structured settlements remain intact. If the insurance company responsible for making the payments becomes insolvent, Assuris steps in to guarantee the continuation of those payments. Recipients can have peace of mind knowing that their financial security is protected.

2. Coverage Limits:

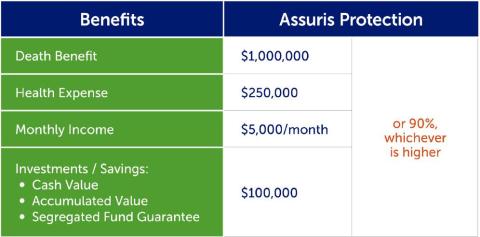

Assuris sets coverage limits that determine the level of protection provided to structured settlement recipients. These limits are designed to strike a balance between safeguarding recipients' interests and maintaining the financial sustainability of the compensation fund. It is essential for recipients to understand the specific coverage limit applicable to their structured settlement.

3. Seamless Payment Transfers:

In the event of an insurance company's failure, Assuris ensures a seamless transfer of payment responsibility. Recipients do not experience interruptions or delays in receiving their structured settlement payments. Assuris facilitates the transfer of payment obligations to another financially stable insurance company, guaranteeing the continuity of payments as outlined in the structured settlement agreement.

Changes to Assuris Coverage Limits

Prior to May 25, 2023, Assuris guaranteed structure payments up to the greater of $2,000 per month or 85% of the monthly payments. As of May 25, 2023, Assuris increased the coverage limits for structured settlements up to the greater of $5,000 per month or 90% of the monthly payments. This increase in coverage provides additional peace of mind for structured settlement recipients. For example, if an individual was receiving structure payments of $4,000 per month, the previous Assuris coverage guaranteed only $3,400 per month (85% of $4,000), whereas the current coverage guarantees the entire $4,000 per month.

Conclusion:

Assuris plays a crucial role in Canada's insurance landscape by providing invaluable protection to individuals receiving structured settlement payments. Its compensation fund ensures that payment streams remain secure, even if the funding insurance company becomes insolvent. With Assuris coverage, structured settlement recipients can have confidence in the continued receipt of their payments, providing long-term financial security. With the increases to the coverage limits, Assuris remains dedicated to upholding the interests of recipients and maintaining stability within the structured settlement framework, fostering trust and peace of mind for individuals across Canada.

For further questions regarding Assuris, you can find more information on their website here. If you have questions about the impact of the Assuris coverage on structure payments, or would like to learn more about the other layers of protection that structures offer, please contact us here.